In this article we cover:

- What the average cost of installing solar panels is

- Payback period with new zero VAT rate

- When the zero VAT rate will be introduced

- What the uptake has been to date

- Why it’s good news for self-builders

The move, due to be signed off on by government the first week of April, will mean a saving of approximately €1,000 to the average solar photovoltaic (PV) installation, bringing the average €9,000 cost for installation down to €8,000, according to the Irish Examiner.

The zero VAT rate will apply to the supply and installation of solar panels on homes and public buildings. All homeowners, including private landlords, whose homes were built and occupied before 2021 can apply, as determined by the date of the meter installation.

The zero VAT rate will apply from May 1, 2023.

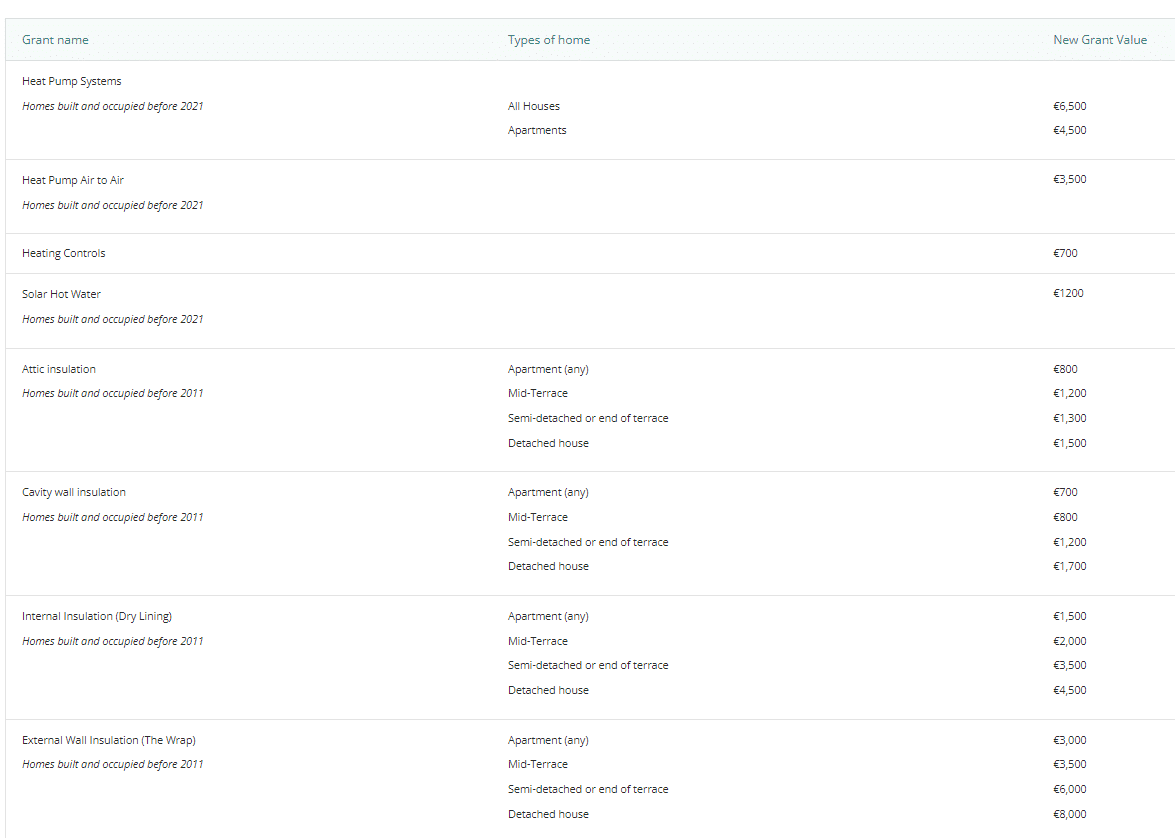

The Sustainable Energy Authority of Ireland (SEAI) grant amounts to up to €2,400, meaning the total average home solar installation will fall to about €5,600.

The average installation installation on Irish homes is 4.5kW, or about 14 solar PV panels.

This is good news for self-builders as new builds do not qualify for the SEAI grants but the zero VAT rate will apply across all installations even if you don’t avail of the grant.

The building regulations require one renewable component, which can be solar.

The Green Party leader said the VAT change will reduce the payback period by just under a year, from seven years to 6.2 years.

“We have set a target to reach 5GW of solar energy by 2025, increasing this to 8GW by 2030,” said Minister Ryan. “Just 1GW is enough to power about 750,000 homes. There is a solar rooftop revolution happening and Government can now help make it more even affordable for people to make the switch to effective and cheaper solar power.”

The VAT rate will be dropped to zero in the Spring Finance Bill. There are almost 50,000 Irish homes with solar panels, according to the Department of Environment.

The Government also plans to put solar panels on all schools by 2025, starting this summer.

UPDATE April 5th: The zero VAT rate will apply from May 1, for all domestic dwellings.

“While this move will help consumers, it will also help the environment. Currently over 50,000 homes have solar panels, with 17,000 solar installations connecting to the grid taking place just last year. This is expected to increase further as prices come down and solar becomes more mainstream,” said Minister Ryan.

The tax rebate comes on the back of an amendments to Annex III of the EU VAT Directive which allows member states to apply a zero rate within category 10c which is for the ‘Supply and installation of solar panels on and adjacent to public and other buildings used for activities in the public interest, housing and private dwellings’.

The Department of Finance has estimated that the measure will cost €19 million annually.