TD urges protection of self-build supports amidst government report that questions €100k in subsidies, loan schemes and tax back schemes.

In this article we cover:

- Details of the new government report about self-building

- Worries supports could be cut

- What the €100k in supports consists of

- Are self-builders getting as much as the government claims?

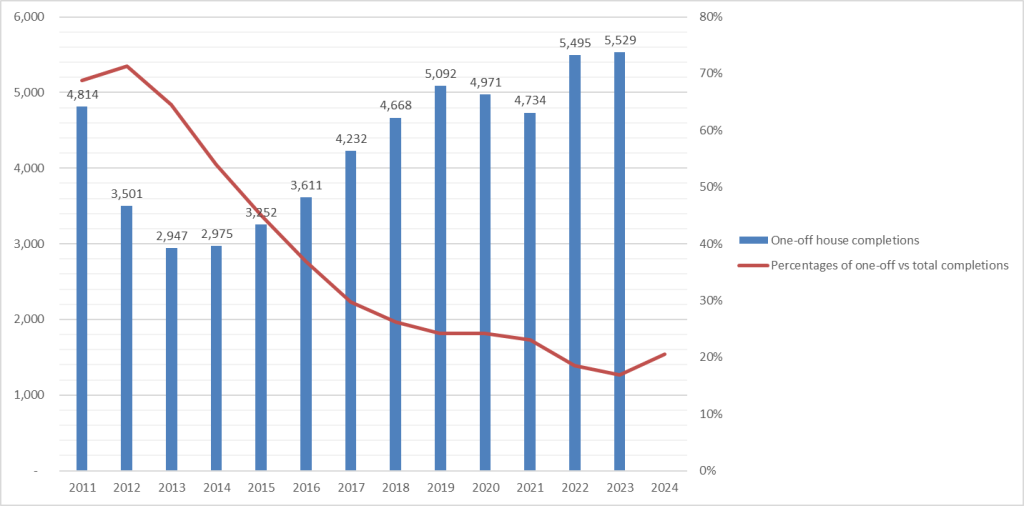

- One in five housing units are one-off houses: full stats

A report by the Department of Public Expenditure has questioned whether self-builders needed financial supports.

These supports, in particular the Help-to-Buy scheme and the development waiver (Irish Water fees waived and development contributions waived), are crucial for first-time buyers building their own homes.

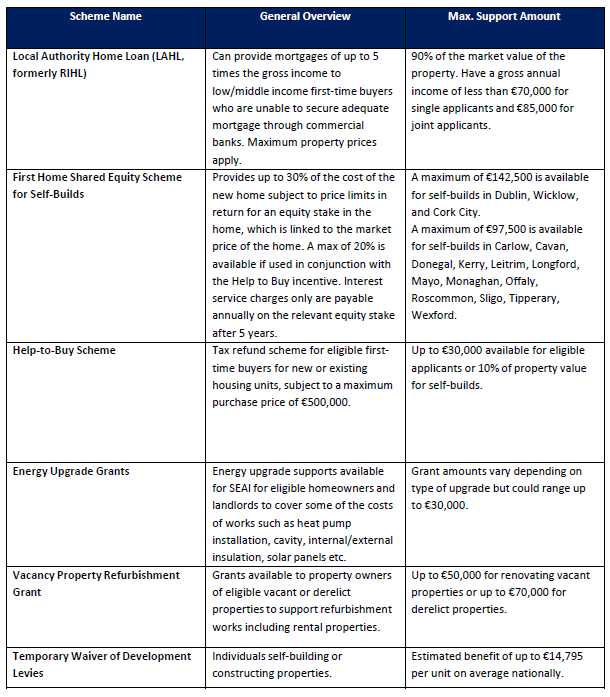

Other supports for those building their home come in the form of loans, including the Local Authority Home Loan, and the First Home Scheme.

Worries supports could be cut

The report has led to worries among TDs that the department was having doubts about continuing supports of up to €100,000 for self-builders, covering those building a new home and those renovating an existing one.

Christopher O’Sullivan, TD for Cork South-West, criticised the department’s analysis, arguing it fails to acknowledge the unique challenges faced by self-builders.

According to the Irish Examiner, O’Sullivan highlighted the significance of rural one-off housing, which accounts for a significant proportion of housing deliveries, arguing that first-time buyers opting to build their own homes deserve the same supports as those purchasing from new developments.

“I regularly meet couples who would not have been able to build their own home without the Local Authority Home Loan, Help-to-Buy scheme and the First Home Scheme,” he said.

“Building your own home can be one of the most stressful and exciting things, at the same time. Self-builders, like other buyers, are susceptible to interest-rate volatility, unavoidable delays and additional costs. They are as deserving of State supports as any other first-time buyer.”

Expressing disappointment with the department’s report, O’Sullivan defended the importance of maintaining support levels for self-builders.

What’s in the report

The Department of Public Expenditure’s One-off Housing in Ireland: Trends and State Funding Supports report raises questions about whether self-builders, meaning those building one-off houses, need as much financial support as they are currently getting.

Here are the main points from the report:

- Self-builds are easier to complete: One-off housing units face less delivery risk and are more likely to be completed compared to high-density developments, so they might not need as much help from the government.

- Better use of funds: The money spent on supporting one-off houses could be used more effectively to build much-needed social and affordable housing in cities where it’s harder to get projects off the ground.

- Household-driven costs: Construction costs for one-off housing are driven by household preferences and funding capacity, leading to significantly larger and more expensive units compared to apartments or multi-unit housing.

- Wide access to support: New policies have made it easier for wealthier households to get government help to build their own homes, letting them build bigger and more expensive houses.

- Need for better targeting: The report suggests that government funds should be targeted more carefully to support building more homes where they are most needed, rather than subsidising large homes for private owners.

What’s in €100k?

The supports for self-builders in ROI are for both new builds and home improvements.

For new builds, there is roughly €50k in direct supports plus loan schemes. While the loan schemes and shared equity schemes help finance the build, the money has to be paid back.

In terms of direct subsidies, new builds benefit of two schemes, the first being the Help to Buy scheme which is a tax back scheme. This means your level of contributions over the years will determine how much you get; the maximum amount is €30k.

The second support is perhaps the biggest help, in large part because it kicks in automatically. Unlike the other schemes, there is no need to apply for it. And that is the waiver on development levies charged by your local authority when you get planning permission, which represents thousands of euros in savings.

How much exactly depends on where you live. This waiver expires in December 2024.

The Irish Water waiver, which has been lumped with the development levies, requires a simple application process to avail of. Developers, including self-builders, are exempt from paying water connection fees, which on average are around €6k, until the end of October 2024.

For those doing up an old house there is €100k available through the energy grants and the vacant property grants which come with an additional grant to pay for professional services. However, these schemes aren’t the most straightforward to navigate.

Here’s the report’s summary of the schemes open to self-builders:

Additional reporting by Astrid Madsen