In this article we cover:

- Trends in single home completions for 2024

- Regional insights

- Broader decline in new home completions

- Factors driving construction activity

- Challenges facing the construction sector

- Housing targets and projections

- Policy initiatives and reforms

The number of one-off homes completed in 2024 in ROI has fallen slightly compared to the previous year, according to the Central Statistics Office (CSO).

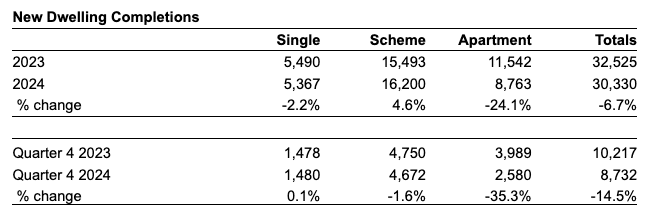

A total of 5,367 single dwellings were completed in 2024, which was down 2.2 per cent from 2023.

However, the final quarter of 2024 saw a positive shift, with a 3.3 per cent rise in completions compared to the previous quarter. (The number of completed homes is based on new domestic electrical connections from ESB Networks).

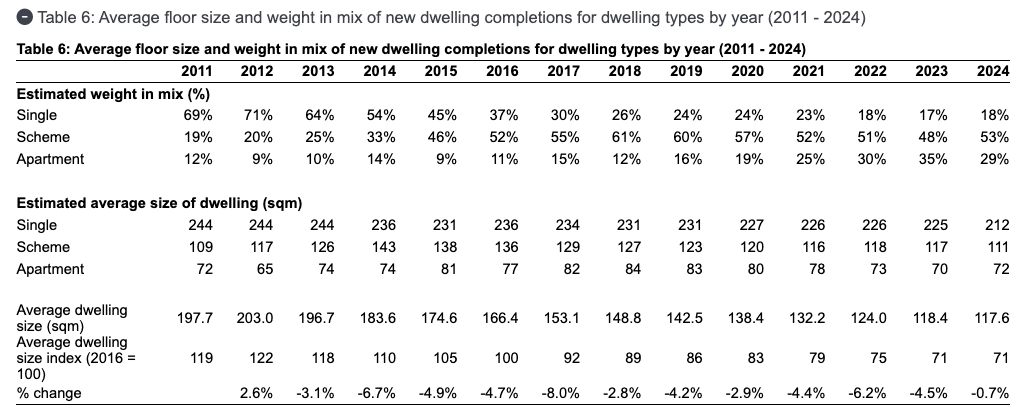

The report also found that the size of single homes is continuing to decrease. The estimated average area of a single dwelling in 2024 is 212 sqm, down from 225 sqm in 2023 and 24 sqm smaller than the average size recorded a decade ago in 2014.

An interesting regional trend emerged in the West (Galway City and County, Mayo and Roscommon), where 16.4 per cent of all ROI single dwellings were completed.

Overall drop

The decline was part of a broader drop in home completions, which totalled 30,330 — 6.7 per cent below the 2023 figure. The biggest dip was for apartments which fell by 24.1 per cent.

The total annual figure falls well short of the 34,000 completions estimated by Stockbroker Davy earlier this month. Davy has projected 42,000 new home completions for 2025 and 50,000 for 2026, figures loosely supported by the over 59,000 homes started in the first 10 months of 2024.

The significant number of building commencements in 2024 could be attributed to the development levy waiver which is expiring at the end of 2026.

Commenting on the latest CSO statistics Ian Lawlor, managing director of Roundtower Capital, described the findings as coming “at a critical juncture for the Irish housing crisis,” and highlighting the urgent need for structural changes to meet Ireland’s housing demands.

“The government in waiting has pledged to build 300,000 new homes by 2030. This is a more appropriate target, though it is potentially on the shy side,” said Lawlor.

Industry leaders such as the Construction Industry Federation, the Irish Home Builders’ Association and Roundtower Capital, have long advocated for annual housing targets of 50,000 to 60,000 new homes to better align with current and projected needs.

Reflecting on the previous government’s performance, Lawlor warned that “unless planning delays, water and electricity connection delays and high building costs are tackled head-on by the new government, they too will fall way short of their housing targets.”

Lawlor highlighted the growing issue of delays in connecting new homes to essential utilities like electricity and water.

“Quite simply, 300,000 new homes will not be able to be built in Ireland by the end of 2030 if power and water cannot get to those houses and if other basic infrastructure is not put in place,” he said.

Despite the hurdles, Lawlor expressed optimism about the new government’s potential to address housing challenges, stating that the incoming leadership “should bring some new energy to the table” and that regional independents may introduce “fresh thinking to the housing problem.” He added that “under the new guard, housing completions should increase this year.”

Despite these positive developments, Lawlor acknowledged that the construction industry continues to face significant hurdles, including labour shortages, supply chain disruptions, and high material costs. He also pointed to a growing skills gap in the sector as a barrier to meeting demand.

“Careful attention to rising construction costs and potential planning and infrastructure delays will be crucial for progress on housing in 2025,” he concluded.

According to the CSO data above, in 2011, 69 per cent of all new dwelling completions were self-builds. With the rise in the number of developer and social housing schemes, in the form of apartments and estates, in 2024 single dwellings represented just 18 per cent of the total completions.

Overall, one-off houses are responsible for a steady 4-5k new completions a year; in 2011 there were 4,814 and in 2024 there were 5,367.