But there is a big problem: technologies for cement decarbonization raise cement production costs and there has historically been little appetite to pay a green premium in the low-margin cement sector.

In the IDTechEx report Decarbonization of Cement 2025-2035: Technologies, Market Forecasts, and Players, many emerging cement decarbonisation technologies such as electrification for kilns/calciners and new cement alternatives are analysed, but the success of these technologies depends on increasing demand for low-carbon cement.

IDTechEx provides research on emerging technologies and their markets.

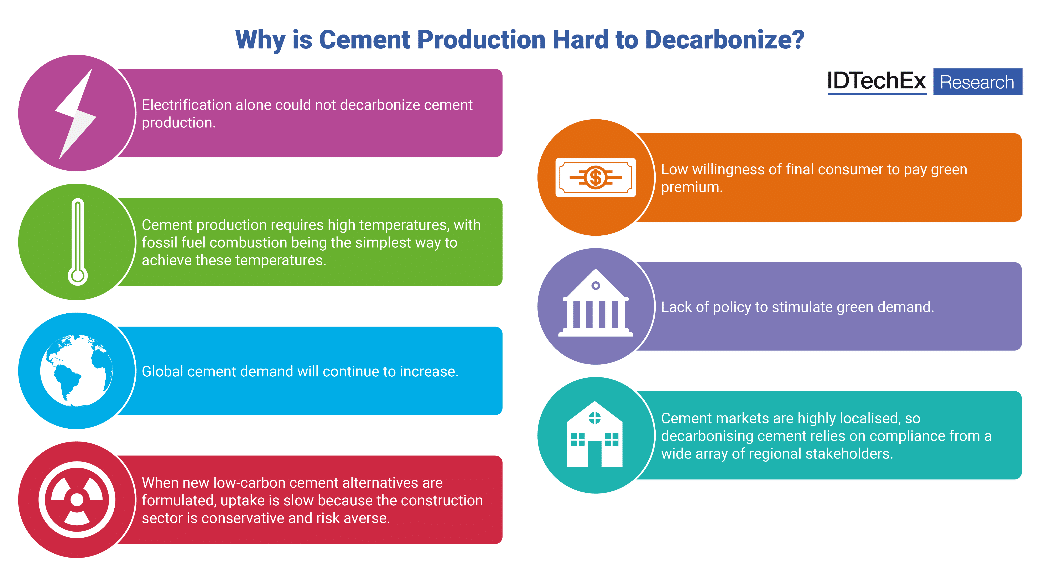

The cement sector is difficult to decarbonize for many reasons. Image source: IDTechEx

Stimulating demand for low carbon cement – private sector

Governments generally have the biggest role to play in global decarbonisation as they strive to reach net-zero targets, including green procurement and emissions trading. But in the private sector, businesses are also increasingly becoming active in the low-carbon cement space. Securing deals with emerging low carbon cement players generates positive press and can help futureproof operations.

This is particularly topical for the major data centre players. The AI boom has not been without its challenges, and the colossal carbon footprints associated with data centres is a cause for concern. AI has been blamed for Microsoft’s greenhouse gas emissions increasing since 2020, despite the company’s intention to become carbon negative by 2030.

Low-carbon cement represents one of many solutions needed to decarbonise data centres. It is therefore unsurprising that in the past two years, Meta announced a partnership with CO2-derived concrete company CarbonBuilt, AWS invested in calcium silicate cement start-up Brimstone, and Microsoft signed a Memorandum of Understanding with electrochemical cement player Sublime Systems.

However, supply chains for low-carbon cement are lacking. There is often a mismatch between where green cement suppliers and end-consumers are located.

Moreover, voluntary demand may be on a project-by-project basis and lack consistent volume, making long-term certainty difficult for emerging green cement players.

Taking inspiration from the power sector, there are now efforts to develop a “book and claim” system for low-carbon cement. This chain of custody model allows the positive environmental attributes of low-carbon cement to be purchased, even though the low-carbon cement is physically used elsewhere.

Purchasers can therefore address supply chain emissions while low-carbon cement start-ups can simplify logistics by always using its cement locally. The book and claim approach would open up a much larger pool of buyers for low-carbon cement products.

Embodied carbon

When it comes to corporate sustainability and emissions reductions targets, scope 3 emissions (indirect greenhouse gas emissions that occur in a company’s value chain but are not produced by the company itself) are hard to quantify and even harder for businesses to reduce. The embodied carbon from construction can often be a significant contributor, with most of this CO2 coming from the cement used.

Making cement from new materials

Modern life is built upon billions of tonnes of new concrete each year. Concrete has reliable characteristics, and due to its excellent performance in construction applications it is the second most consumed material on Earth (behind only water). Cement, concrete’s key ingredient, is made from limestone. However, the underlying calcium carbonate chemical composition of limestone means that the CaO compound crucial for cement can only be unlocked by releasing CO2, resulting in a high carbon footprint.

Therefore, green cement players are exploring new starting materials other than limestone that can produce similar or identical cements with well-understood and reliable properties. For example, other cheap abundant calcium sources include basaltic rocks and calcium silicates. Some of the players innovating in this space including Solidia Technologies, Brimstone, Sublime Systems, and C-Crete. Each company has developed its preferred approach to cement-making – from lower-temperature kiln processes, to using electrochemistry, or mechanochemical activation.

Another option, with added circularity benefits, is to reactivate cement paste recovered from demolition concrete. This has been trialled by industry leader Heidelberg Materials via the recycling of captured CO2. Also, start-up Cambridge Electric Cement is developing its own approach based on co-processing during steel-making in electric arc furnaces.

Replace cement with waste materials (new cement chemistries)

The cement sector is no stranger to valorising waste materials and preventing them from going to landfill. Repurposing waste such as coal fly ash from the energy sector and GBFS (granulated blast furnace slag) from the steel sector as supplementary cementitious materials (partial replacements for cement) is already well-established. But green cement innovators want to take this further, utilizing even greater amounts of industrial waste streams through alternative cement chemistries.

Alternative cements based on alkali-activation and CO2 mineralization for hardening and strengthening are being developed. These different routes can produce cements with desirable properties using increasing amounts of fly ash or steel slag.

Cement alternative space covered in the IDTechEx Decarbonization of Cement 2025-2035 report and relation to conventional OPC (Ordinary Portland cement). Source: IDTechEx

Replace fossil fuels with renewable power

Taking inspiration from the transportation sector, electrifying the cement production process and using renewable energy is another pathway towards cement decarbonization. The difficulty here is achieving the high temperatures required for cement making economically and efficiently that does not involve fossil fuel combustion.

Key development areas include efficient heat transfer and thermal energy storage (to account for the intermittent nature of certain renewable energy sources, such as wind and solar).

Finland-based Coolbrook has developed rotodynamic heating technology, which enables fully electric high temperature heat generation up to 1,700degC with a high electricity-to-heat generation efficiency.

Synhelion’s approach, currently being developed with major cement producer CEMEX, skips the electrification stage by utilising heat directly from the sun (concentrated solar power), deploying thermal energy storage and its own solar receiver design.

Such technologies are promising not only in the cement sector, but also for decarbonising other high temperature carbon intensive industries such as steel and petrochemicals.

Outlook

Global demand for low-carbon cement is increasing. Government regulation for low-carbon cement production is strongest in the European Union, and the US government has been particularly active in green public procurement. Private sector demand is growing, and the advent of book and claim systems could accelerate this market even further.

While businesses may have limited involvement in the selection of materials when constructing new premises, the green cement space is working to expand access of low-carbon cement to bigger pools of buyers.

Over recent years, this may have taken the form of carbon credits, or the emerging book and claim chain of custody model. Already used by some businesses to lower aviation-related scope 3 emissions from transportation/travel via the purchasing of sustainable aviation fuel (SAF), book and claim enables businesses to purchase the sustainability benefits of green cement when access to the physical concrete product is limited.

Microsoft championed this environmental attribute certificate approach to cement decarbonization and is expected to become increasingly popular as companies strive to reduce scope 3 CO2 emissions.