In this article we cover:

- Current build costs and common budget busters

- Steps to costing your build and how it interacts with the design

- Self-build mortgages

- Top 5 areas that will save you money

- Schedules of work versus bill of quantities

Before you start on your design, you’ll need to determine how much you’re prepared to spend on your project. It could be what money you have saved or the value of your current home, or the maximum amount a mortgage provider will lend.

Affordability is key so don’t overestimate what you can comfortably afford. This will be your starting point to start on your house design.

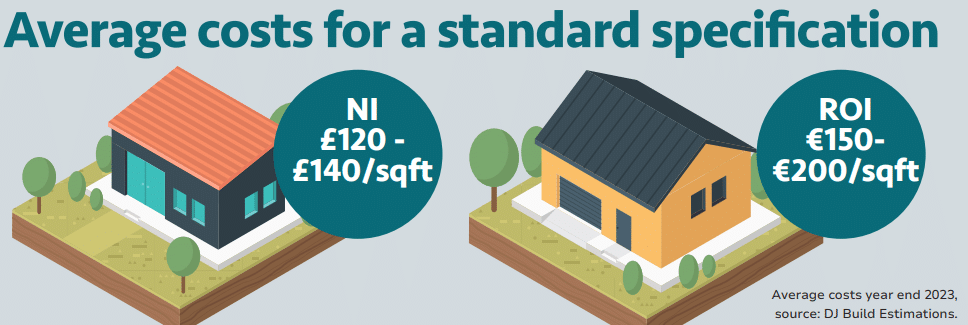

As a self-builder you can apply a conservative £ or € per square metre rule of thumb at the initial stages, to get your house designed. After that you can get a costing done up based on standard specifications, but it’s likely that you will want to go higher spec than what’s considered standard for a developer.

As self-builds are bespoke, a more accurate cost will only become available once a quantity surveyor has your fully detailed and specified set of plans (construction drawings).

Common budget busters: Location (with Dublin being particularly expensive for labour) and specification (high end finishes such as underfloor heating and high spec roof can easily add 40k to a project).

This is when you can start itemising and making decisions on the specification. The devil really is in the detail as costing a project accurately will depend on availability and the current market rates. Have a list of items you are happy to compromise on, because during the build you may need to find ways to cut down on costs.

It’s unlikely you will be happy with a standard specification; most self-builders go higher spec.

Using a per square metre or square foot figure beyond the very initial stages is misleading, and can lead to issues on site when you find out how much the finish you want actually costs. Cost engineering, or changing the specification to cut costs, should be done at the design stages to avoid panic buying.

Bar exceptional circumstances, there is no reason for you to go overbudget if you have construction drawings that have been costed by a quantity surveyor.

However, contingencies are still advisable. Foundations are the notorious wildcard in that they may require more groundwork than what’s considered standard (extra digging and/or need for more complicated foundations due to soil conditions).

Schedules of work vs bill of quantities: The schedules of work are usually done by your designer and it’s a room by room account of general costs, or it can be done by trade. A bill of quantity is a much more detailed document, devised by a quantity surveyor. It itemises the cost of every item that goes into the build and the labour rates for each job.

Self-build mortgages

If you plan to borrow the money to build your house, speak to a mortgage advisor early on. In part because of insurance, some banks will not lend if the house does not conform to their standards. They may be wary about non-traditional roofs such as large flat roof areas, or sites with a shared road access, for example.

Self-build mortgages work differently from standard ones. Instead of a lump sum, the bank releases funds in stages as your home is built. You only pay interest on what you’ve drawn down.

As the build progresses, usually over 18 months, the bank issues stage payments. Each stage requires proof of completion, signed off on by your architectural designer or engineer, before funds are released.

The first stage payment is often delayed due to the paperwork involved; once the process is set up the following stage payments tend to be released quickly. The last stage payment, which requires all completion certificates, also tends to be lengthy to release.

In NI, you can borrow up to 75 per cent of project costs or more if you own the land. In ROI, lenders offer up to four times your income, with a 10 per cent deposit required, plus a contingency fund.

You’ll need a site and planning permission before applying. Some lenders accept the site as a deposit.

Where to save on your self-build Ireland

House size. You may not need as big a house as you think; with good design, a smaller house can deliver the same usable space. Compact, rectangular shapes are most cost effective to build and heat.

Windows. It’s not just the size and amount of glazing that will save you money. You might be better off with a regular sized window on two orientations (better light quality) than one large expanse of glass on one orientation. Or you can look at breaking up the panes into sections, rather than have one large expanse of glass which of course is more architecturally striking. Remember too that a large expanse of glass at night will be a sheet of black, so you will need to think of how to dress it, i.e. curtains or blinds (it’s costly).

Bathrooms. Limit the number of bathrooms, e.g. consider a Jack and Jill instead of investing in a series of small ensuites. Some simple hacks include only tiling portions of the bathroom and sourcing furniture secondhand.

Kitchens. The most common budget buster, the kitchen can easily add tens of thousands to the final bill. Plan ahead to get what you want within the budget you’ve got.

Shop around. There are big savings to be had when you shop around, e.g. hot water taps thrown in for free. If you find a supplier you like and buy enough from them, discounts should be available.